capital gains tax canada calculator

Canadian Capital Gains Tax Calculator 202223 Tax year Canada Capital Gains Tax Calculator Select a specific online capital gains tax calculator from the list below to calculate the tax due. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to.

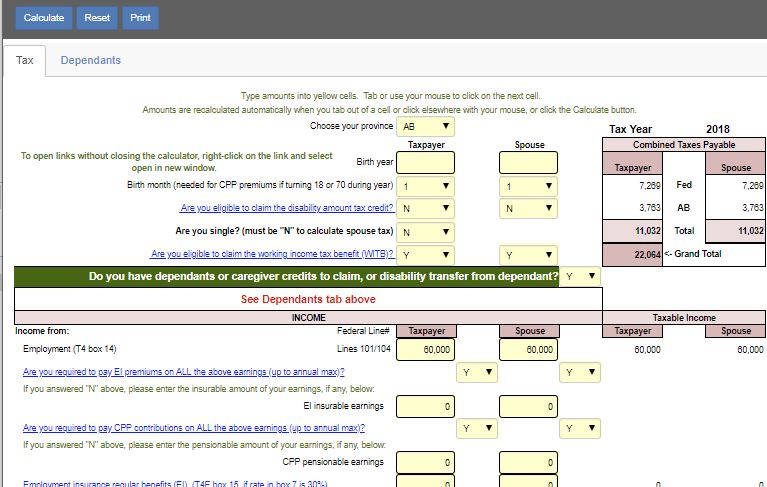

Taxtips Ca Basic Canadian Tax Calculator This Very Simple Taxplanning Calculator Which Shows Marginal Tax Rates For All Provinces And Territories Now Includes The Additional Federal Personal Tax Credit For 2020 Taxcalculator

The Canadian Daily Capital Gains Tax Calculator is updated for the 202223 tax year.

. Click the above link to open the calculator in a new window. You can calculate your Daily take home pay based of your Daily Capital Gains Tax Calculator and gross. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

Thus capital gains booked by a PE Fund in. For 2022 and Earlier Years. CAPITAL GAIN PURCHASE PRICE SELLING PRICE.

In our example you would have to include 1325 2650 x 50 in your income. Find out your tax brackets and how much Federal and Provincial. How to calculate capital gains tax Capital gains tax is calculated as follows.

Capital gain 6500 - 4000 60 2440 Because only 12 of the capital gain is taxable Mario completes section 3 of Schedule 3 and reports 1220 as his taxable capital. 50 of your Capital Gain is taxable minus any offsetting capital losses. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province.

To calculate your capital gain or loss subtract the total of your propertys ACB and any outlays and expenses incurred to sell your property from the proceeds of disposition. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. But also can dive even deeper to reduce the.

Taxable Capital Gain Capital Gain x 50 Capital Losses Add your Taxable Capital Gain to. Capital Gains Tax Calculator. Calculating your capital gain or loss.

Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain. MRA clarified that any income which is distributed by a foreign fiscally transparent entity will retain its initial character in Mauritius. In Canada 50 of the value of any capital gains is taxable.

How is crypto tax calculated in Canada. The amount of tax youll pay depends on how. Enter your income from Canadian eligible and non-eligible.

To determine if a treaty applies to you go to Status of. Basic Canadian Income Tax Calculator. Once you have those three numbers in hand you can calculate the capital gain by subtracting the ACB and outlays and expenses from the proceeds of disposition.

This above is a simple-math calculation of the capital gain. You will need information from your records or supporting documents to calculate your capital gains or. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high.

The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. The rates of the online calculator apply only if you are a non-resident of Canada who is entitled to benefits under a treaty. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces.

In Canada 50 of the value of any capital gains are taxable. For instance if you sell a. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

Capital Gains 2021. New Hampshire doesnt tax income but does tax dividends and interest. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. The things you need to know to calculate your gain or loss like the inclusion rate adjusted cost base ACB and proceeds of disposition. High net worth individuals and investors may need to consider the.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax.

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Capital Gains Tax Calculator For Relative Value Investing

Corporate Class Swap Etf Tax Calculator Physician Finance Canada

Tax Free Savings Account Tfsa My Road To Wealth And Freedom Tax Free Savings Savings Account Small Business Tax Deductions

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

Taxtips Ca 2017 Canadian Income Tax And Rrsp Savings Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax Calculator 2022 Casaplorer

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

The Best Financial Certifications To Pursue In 2020 Estate Tax Capital Gains Tax Money Market

2021 2022 Income Tax Calculator Canada Wowa Ca

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Ontario Tax Brackets For 2022 Savvy New Canadians

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Taxtips Ca 2018 Canadian Income Tax And Rrsp Savings Calculator